Edito

ESG criteria has been a part of our investment process for several years

Our ESG approach runs through our entire value chain. We see ESG as a supplemental means of controlling risk in our portfolios, complementing and enriching the traditional view of investment based on financial, accounting and stock market criteria. The concept of ESG provides real added value for portfolio management.

Our policies

Our ESG approach is based on 3 policies

Extra-financial positioning

With a view to reinforcing transparency in extra-financial matters, the Autorité des Marchés Financiers (AMF) has imposed new obligations on management companies since 10 March 2021 with its Position-Recommendation No. 2020-03 (“AMF Doctrine”), requiring them to position their range of UCIs according to the extent to which extra-financial criteria are taken into account in their investment process.

ESG ratings and follow-up of setbacks

As part of the ESG project, we have developed two internal methodologies for rating, respectively, sovereign issuers and private issuers.

We have defined criteria for each of the cornerstones: Environment, Social and Governance, which are then subdivided into what we consider to be the basic indicators common to all private issuers. And we have done the same for sovereign issuers.

By consolidating the ratings according to indicator, then criteria, we obtain a positive, neutral or negative rating for each cornerstone: E, S and G.

A sudden drop in a rating can trigger an alert to management and may be followed up in more detail via the shareholder dialogue process.

Our contribution to the energy transition and climate indicator

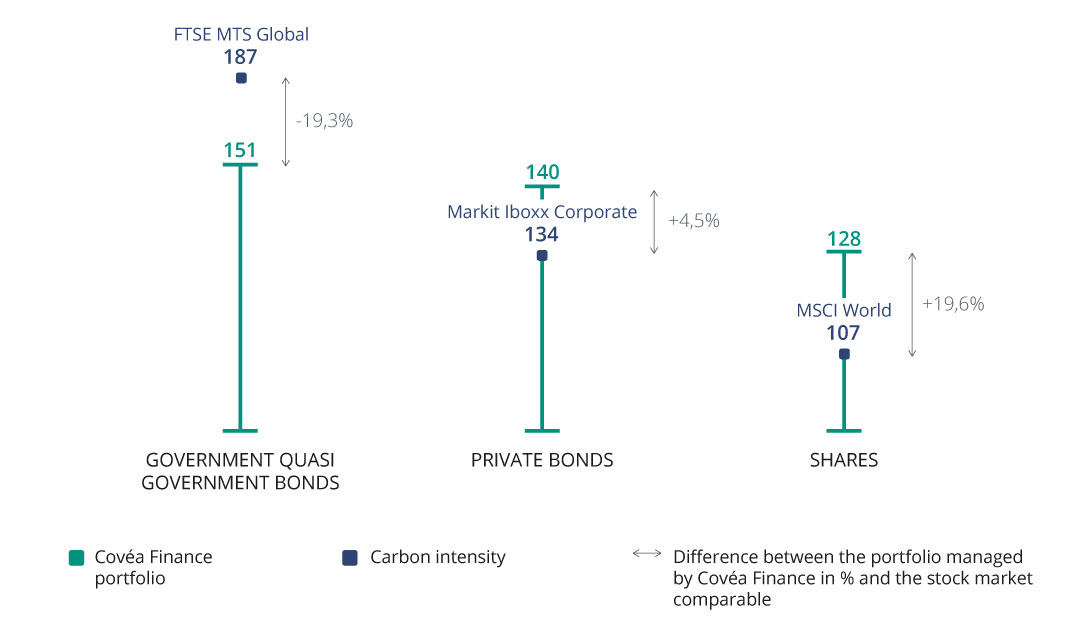

We publish our asset portfolio’s carbon intensity on a yearly basis. Monitoring can be done at the corporate, state or portfolio level.

Carbon intensity

Carbon intensity by type of emitter and comparison with stock market comparables.

Carbon intensity of GDP by asset pocket in tonnes of CO2/M€ of GDP or sales, current.

For entities subject to reporting obligations, the law provides for an eligibility threshold of €500 million in assets or balance sheet size. This threshold determines the nature and content of the duty of information.

At the end of 2023, the open funds strictly falling within the eligibility thresholds enacted by the implementing decree were:

Individual reports are available for each of the eligible open-ended funds. In addition, because of our collegial management model, we continue to publish this consolidated report for all our funds and mandates. On the other hand, each year we also publish an individual report on open-ended funds targeting specific and clearly identifiable ESG themes.

For the 2023 financial year, the following four environmental-themed funds were the subject of an individual report available on their page: https://vds.issgovernance.com/vds/#/NDY0Nw==